Machine Learning For Fraud Detection

Machine Learning For Fraud Detection

Technological innovation has been the backbone of major growth drivers in the last 250 years. If the ‘Spinning Jenny’ was the watershed moment to usher in the Industrial Revolution, in the current era, Internet of Things (IoT), big data, and AI are causing a rethink marking the Fourth Industrial Revolution.

Now, with the dawn of machine learning, the future is up for a major change. In the words of Bill Gates, “A breakthrough in machine learning would be worth ten Microsofts.”

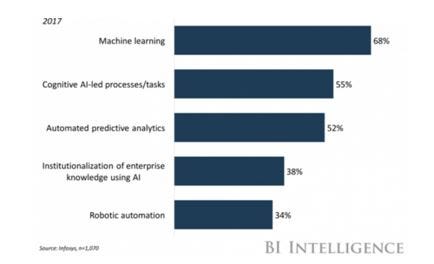

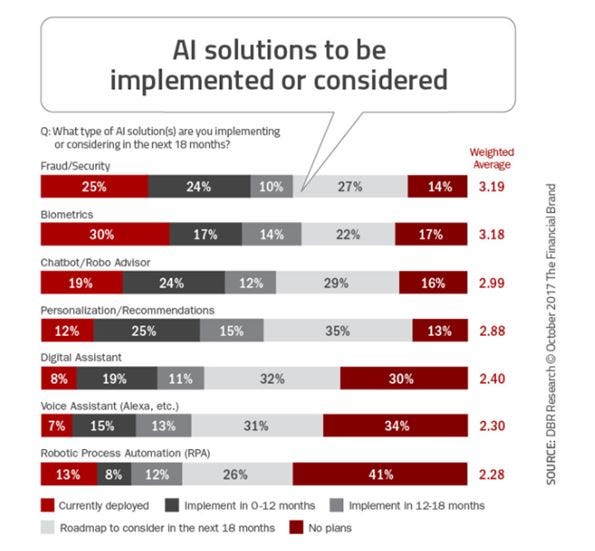

One of the biggest applications and the most useful aspects of machine learning would be in the financial industry. With greater technological innovation comes bigger risks for existing financial institutions such as fraudulent transactions across several sectors like insurance, retail, banking, and sales. With their highly sophisticated fraud screening systems, machines are now the new age ‘fraud detectives’ for these institutions.

The PwC Global Economic Crime Survey, 2016, suggests that more than one in three (36%) of organisations experienced economic crimes.

Taking safety measures against a fraudulent crime is a top priority for any financial institution. Even if a minor percentage of such a crime went undetected by human-driven systems, it could spiral into major losses for the organisation.

The usual method of rule-based systems followed by financial institutions is inefficient in detecting fraud. Criminals are adapting to better technology with crimes becoming increasingly sophisticated. Machine learning and stream computing technologies are the best way to combat these complex fraudulent activities.

Machines can look at volumes of data including texts, images, and videos, analyze a pattern and detect an anomaly within seconds with high accuracy. SAS, one of the pioneers of machine learning since the 1980s, have been using machines and neural networks to tackle credit card frauds. Now, several financial sectors are shifting from their old solutions for fraud detection to pattern analogy study using machine learning to tackle fraudulent cases.

Michael Ames, Senior Director of Data Science and Emerging Technology, SAS has said, “There is a creative aspect or ‘art’ to machine learning for fraud detection. It is the application of machine learning in new and novel ways, like combining a variety of supervised and unsupervised methods in one system to be more effective than any single method alone.”

Machine learning usually combines human pattern recognition skills with automated data algorithms. They can be both supervised learning methods (logistic regression, neural networks, decision trees, gradient boosting machines, random forests, support vector machines etc) or unsupervised learning methods (self-organizing maps, k-means, DBSCAN, kernel density estimates, one-class support vector machines, principal component analysis).

In supervised learning, samples of available data are manually classified as either ‘fraudulent’ or ‘non-fraudulent’. Unsupervised methods, on the other hand, do not make use of labeled records.

Both these methods seek for accounts, customers, suppliers, etc. that behave ‘unusually’ in order to output suspicion scores, rules or visual anomalies, depending on the method.

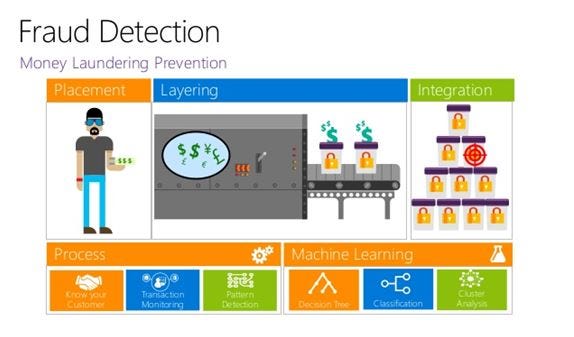

The machine learning for fraud detection tools mainly comprise data collection, applying various machine learning-based methods, integration into operations, white boxing and ongoing monitoring

Machines facilitate real-time decision-making, improve accuracy, respond rapidly to change and lower costs. The big challenge for fraud detection is to identify foul transactions while maintaining quality customer service by making sure not to decline legitimate transactions.

Machines, therefore, are the best bet to handle the challenge and correctly identify the following:

A) A primary fraud score, which relates to a fraudulent account

B) A transactional score which identifies a specific fraudulent transaction

Below are some of the areas where machine learning is being used for fraud detection:

Insurance: Insurance fraud may be committed by applicants for insurance, policyholders, third-party claimants at different points in the insurance transaction. Common frauds include “padding,” or inflating actual claims; misrepresenting facts on an insurance application; submitting claims for health, injuries or damage that never occurred, services never rendered or equipment never delivered and “staging” accidents.

Conservatively, stats show that fraud steals $80 billion a year across all lines of insurance in the US alone.

Over 90% of online fraud detection platforms use transaction rules to direct suspicious transactions through to human review. Nevertheless, criminals use malware and phishing emails to hack a user’s account and commit a crime. Therefore, this traditional approach leads to loss of a genuine client.

Machine learning, on the other hand, applies cognitive computing technologies to raw data using complex algorithms and processing thousands of data and detects anomalies quickly, scale and accuracy. This way it can avoid a false/positive case of an insurance fraud too. Unsupervised machine learning models can continuously upgrade its models by analysing and processing new data.

Banking: A variety of financial transactions, including credit cards, ATMs, and e-payments are highly vulnerable to fraud. Machines can apply complicated logic outside the capacity of human analysis to a huge flow of data streaming and therefore prevent a fraud, detect actual cases of real fraud, reject false/positive cases of fraud with minimum hassle.

Thus, a bank can forewarn a client after identifying a legal transaction which can potentially risk a high chance of a fraudulent activity to take a proactive measure. There are other machine learning models that allow a bank to combat fraud before it can actually occur.

Retail: Fraud is identified as one of the biggest causes of lost revenue for both brick and mortar and online retailers, especially with the rise of e-commerce. retail industries also suffer from fraud at Point of Sale (POS).

Machine learning can accurately identify several anomalies using predictive pattern analysis in EMV-driven online fraud, account takeover/loyalty fraud, returns fraud and automated fraud among others.

Some supermarkets have started using digitised CCTV together with POS data in places most susceptible to fraudulent transactions.

Machine learning is fighting fraud in almost all the complex processes of the financial ecosystem. On the other hand, with more advanced technology, serial fraudsters are constantly upgrading their skills. However, a machine learns from every transaction and hence its accuracy only builds up over time.